The End of the Magic Money Illusion

The era of cheap debt is over — and Britain is finally waking up to the cost of its illusions.

I. The Illusion We’ve Been Living

For much of the past two decades, Britain has been operating under the illusion that money is limitless. The 2008 financial crash, the COVID-19 pandemic, and a decade of ultra-low interest rates helped cultivate the belief that governments could always step in, borrow more, and spend their way out of trouble. But that illusion is now collapsing.

In its Fiscal Risks and Sustainability report from September 2024, the Office for Budget Responsibility (OBR) warned that, without policy change, Britain’s public debt could reach 274% of GDP by 2070 — up from under 100% today. This isn’t a fringe opinion. This is Britain’s official fiscal watchdog sounding the alarm. [OBR, September 2024: https://obr.uk]

Subscribe to The Third Island for serious, fact-based commentary on Britain’s future.

II. Unsustainable Arithmetic

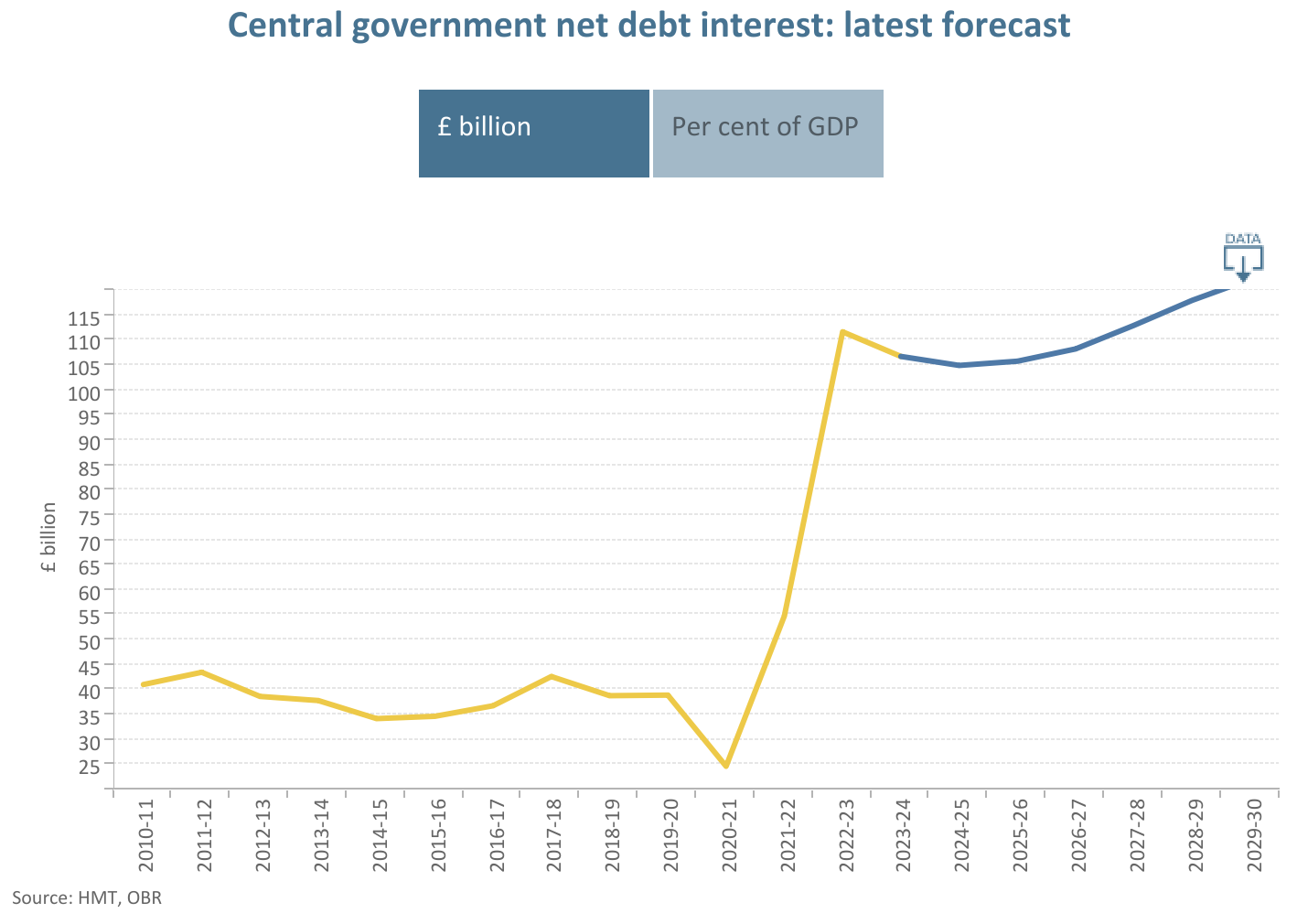

Public finances are not merely under pressure — they are structurally broken. Debt interest alone now competes with core departmental budgets. According to the OBR’s March 2025 Economic and Fiscal Outlook, the UK spent £112.6 billionon debt interest in 2023–24 — about 10.1% of total public spending, more than it spent on education or policing [OBR, Economic and Fiscal Outlook, March 2025 https://obr.uk]

A House of Lords Economic Affairs Committee report from early 2024 cited long-term demographic pressures — particularly an ageing population and rising healthcare and pension costs — as key drivers of structural deficits. These are not one-off emergencies. They are long-term obligations with no clear plan to fund them. [HL Paper 38, 2024: https://publications.parliament.uk]

Meanwhile, local services are visibly collapsing. Councils from Birmingham to Croydon are declaring effective bankruptcy. NHS waiting lists have surpassed 7.5 million, and prisons are operating over capacity. Yet politicians continue to behave as if Britain is simply going through a rough patch — not a fundamental reckoning.

III. A Culture of Denial

There is a pervasive culture of denial in Westminster. Chancellors and shadow chancellors alike make speeches promising growth, fairness, or prudence — but sidestep the real numbers. According to the National Audit Office, the total estimated cost of pandemic-era measures stands at £376 billion, covering furloughs, business loans, PPE, and public health responses. [NAO COVID Cost Tracker, 2023: https://www.nao.org.uk]

While many of those measures were necessary, post-crisis fiscal discipline never followed. Instead, the UK layered new borrowing atop old, with no serious attempt to reorient public spending around what is affordable in the long term.

The triple lock on pensions, unaffordable public sector entitlements, and expanding welfare commitments continue — not because the country can afford them, but because no one dares challenge them. The Institute for Fiscal Studies (IFS) estimates that both major parties’ plans leave a £30–£40 billion fiscal black hole — an intentional omission from their pre-election platforms. [IFS Green Budget, 2024: https://ifs.org.uk]

IV. Black Holes and Political Cowardice

This evasiveness is not benign. It corrodes democratic accountability. By avoiding hard truths, Britain’s political class is outsourcing future pain to younger generations.

As the IFS and Resolution Foundation have noted repeatedly, Britain is becoming increasingly reliant on stealth taxation, frozen thresholds, and one-off windfalls to maintain the appearance of control — all while public confidence in the competence of government continues to erode. [Resolution Foundation, 2024 Budget Analysis: https://resolutionfoundation.org]

Meanwhile, every Budget becomes a performance — an exercise in narrative management, not strategy. Ministers refuse to say where cuts will fall, or what taxes will rise. The result is a fiscal fiction: numbers that don’t add up, but are presented with fanfare as if they do.

Subscribe to The Third Island for serious, fact-based commentary on Britain’s future.

V. Why It Matters

This is not just about economics. It’s about sovereignty and intergenerational justice. Every additional pound spent on interest payments is a pound not spent on repairing roads, rebuilding schools, or investing in innovation. In the long run, this weakens national resilience.

Britain’s credit rating has been downgraded multiple times in the past decade — most recently by Fitch in April 2023, which cited high and rising debt as a key concern. [Fitch Ratings, April 2023: https://fitchratings.com]

And Britain is particularly vulnerable. Its reliance on global capital markets and its exposure to currency volatility mean that any crisis of confidence in UK debt could result in rapidly rising borrowing costs — which would, in turn, compound the crisis.

UK debt interest payments have surged in recent years — forecast to exceed £110 billion by 2029–30. Source: Office for Budget Responsibility

VI. The Way Forward

This is not a call for bone-deep austerity. It is a call for honesty. Britain needs a new fiscal settlement — one that acknowledges trade-offs, links spending to outcomes, and restores accountability.

That means:

· A review of all entitlement programmes, including state pensions, public sector pay, and unfunded guarantees.

· A credible conversation about tax reform, including closing avoidance loopholes and broadening the base.

· The reintroduction of clear, binding fiscal rules that cannot be abandoned for short-term political gain.

None of this will be easy. But the alternative — further erosion of trust and financial credibility — will be worse.

VII. When the Illusion Breaks

We are nearing the moment when the illusion breaks. And when it does, the reckoning will not be polite. The myth of the magic money tree has lulled Britain into a false sense of security. But trees cannot grow forever. And neither can debt.

The state is not limitless. It is a ledger of obligations. And for too long, Britain has been writing cheques that the future cannot cash.

Enjoying The Third Island? Subscribe to get new posts direct to your inbox.